- Office 614, Al Attar Business Center, Al Barsha 1, Dubai

- info@shurabridge.com

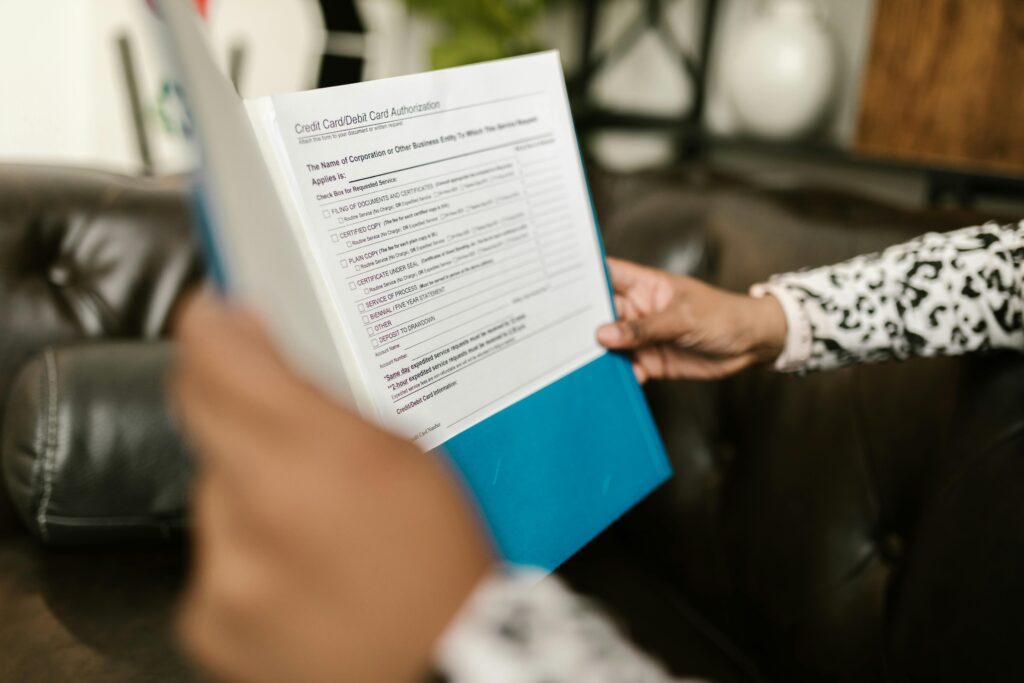

AML Compliance

Ensure Compliance, Minimize Risk with AML Solutions

We provide comprehensive AML compliance services in the UAE, ensuring your business is protected against financial crime. Our expert team helps develop and implement anti-money laundering policies that meet UAE regulations. From risk assessments to ongoing monitoring, we keep your business compliant and safe from penalties, safeguarding your reputation and financial integrity with thorough, customized solutions for your specific needs.

AML Policy Development and Implementation

We help businesses create and implement robust AML policies, ensuring compliance with UAE laws. Our services include drafting policies tailored to your operations, training your staff, and monitoring the policy’s effectiveness. Our approach ensures that your business is equipped with the right tools to prevent money laundering risks and meet regulatory expectations.

Customer Due Diligence

Customer Due Diligence (CDD) and Know Your Customer (KYC)

We implement effective CDD and KYC procedures to help businesses verify the identity of clients. We ensure compliance with local AML regulations by gathering and analyzing the necessary customer data, preventing financial crimes. Our thorough processes reduce risks, giving your business the confidence to operate securely and within the law.

Assessment and Mitigation

AML Risk Assessment and Mitigation

Our AML risk assessment services evaluate your business’s exposure to money laundering risks. We identify potential vulnerabilities and creates mitigation strategies to address them, keeping your company compliant and safe from regulatory issues. We provide ongoing monitoring and updates to ensure your AML practices remain effective and up-to-date.